Today on offer: climate rescue at a bargain price

A drastic reduction in global CO2 emissions can be cheap — if central banks help.

by Dr. Matthias Kroll, Chief Economist, World Future Council

We are currently experiencing for the second time (after the big bank crash of 2008) what enormous financial resources can be mobilized in a systemically relevant crisis. The rapid mobilization of large sums of money by central banks and governments raises the question of why, in the equally systemically important global climate emergency, it has been necessary to beg for every single billion for years.

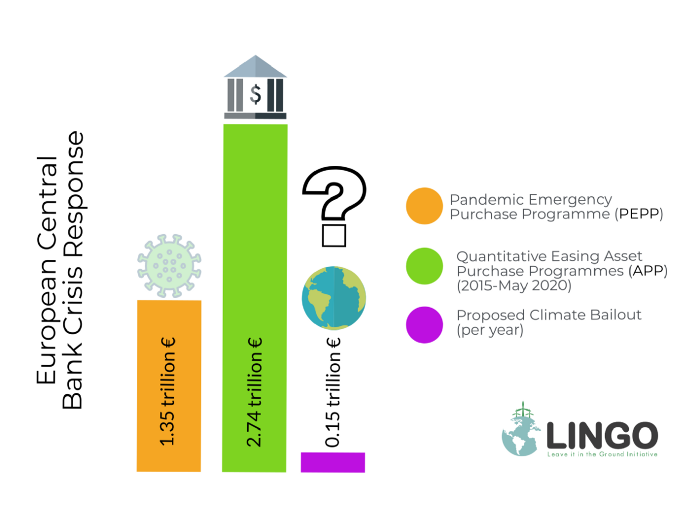

The corona pandemic has not only pushed the climate crisis into the background in the media, it has also attracted lots of financial resources. Today, the financial means available to deal with the corona crisis exceed the funds required — but not approved — to stabilize the global climate at 1.5°C many times over. The European Central Bank (ECB) alone has recently increased its Pandemic Emergency Purchase Program to 1.35 trillion (1,350 billion!) €. In view of the dramatic slump in many industries, an intervention of this magnitude can actually be rated as essential. The price for coping with the systemically relevant climate crisis, on the other hand, appears almost to be a bargain: with a fraction of the funds used to overcome the Corona crisis (or the banking crisis of 2008), the central banks could make investments in climate protection of a magnitude that would make the 1.5°C target achievable. The central banks would not even need to create additional money for this. It would be sufficient to replace expiring assets from previous purchase programs with new types of “Green Climate Bonds”.

Compared to ECB spending on other crises, a Climate Bailout needs modest resources. Image: LINGO

The global expansion of renewable energies must accelerate massively

A UNEP report published in June 2020 once again showed a dire shortfall in renewable energy investments, despite a flood of articles about ‘sustainable’ and ‘green finance’ in specialist media: global renewable energy investments have stagnated at around $ 300 billion a year since 2011. The fact that the installed capacity in GW nevertheless shows a slight but steady increase is due to the fact that wind and solar technology can be manufactured more and more cost-effectively.

Even the fact that renewable energies can now produce electricity more cheaply than fossil fuels has still not led to a rapid expansion. Investors continue to finance dirty energies because their costs and risks have been known for decades and enable reliable calculations — which make a project bankable in the first place. By contrast, investments in renewable energies are still considered to be risky and difficult to calculate, particularly in countries of the Global South.

The slower-than-expected expansion of renewable energies is not due to a lack of potential ‘green’ capital, but to a blatant lack of bankable renewable energy investment projects. This also means that the often demanded redirection of capital from fossil to renewable energies — due to a presumed shortage of investment capital — misses the core of the problem.

How central banks can make renewable energy projects bankable

For the problem of investment risks that are difficult to calculate, sureties are the obvious solution, where central banks cover the risk — and only the risk — of a default. In some countries, an obstacle to investment is that the price of electricity from renewable energy would collide with the Sustainable Development Goal #7 (affordable energy for all). In that case, grants can help. We need new financing tools that can 1) back guarantees on a large scale and 2) enable substantial grants. In principle, both approaches can already be offered to a very small extent by international development banks. In order to bring the expansion of renewables into a ballpark that allows us to achieve the Paris climate goals, development banks however need a strong economic partner at their side: the central banks.

Christine Lagarde has been a proponent of more effective climate action of central banks such as the European Central Bank she presides. Image: World Economic Forum

The state central banks of the industrialized world are without a doubt the most powerful economic institutions in the world. They can never go bankrupt in their own currency and can even continue to exist with negative equity. Fortunately, most of the major central banks have recognized in recent years (e.g. through the establishment of the ‘Network for Greening the Financial System’) that the risks of the global climate crisis pose massive risks to the financial system — and thus climate change constitutes part of their mandate. So far, however, their measures have only been directed at making climate risks more transparent for various companies and industries in order to provide investors with the relevant information. It is obvious that such a soft form of intervention will not be enough to effectively counteract the climate emergency.

It would be much more effective if the central banks would allow the development banks to sell guarantees to them on a permanent basis. This would minimize the risk for the development banks and multiply the number of renewable energy projects enabled by guarantees. The central banks could also allow development banks to sell green climate bonds to them with such long terms that they are in effect non-repayable grants. This would also multiply the number of bankable renewable energy investment projects.

A Climate Bailout could enable a swift shut-down of fossils and ramp-up of renewables through innovative energy transition bonds. Image: Pixabay

180-degree turn for the fossil industry: turn dirty into clean

Central banks can also enable an urgently needed turnaround for the fossil industry. They could offer companies to absorb their assets threatened by “stranding”, such as oil or coal still in the ground — so that these are not burned. Companies would have to invest the money received into new and additional renewable energies or other CO2-saving technologies. The limited funds of the central bank’s purchase programs would be given to those companies that offer the greatest CO2 savings per monetary unit in an auction-style process. Smart financial mechanisms for quickly retiring the world’s coal plants and replacing them with renewables plus storage will be described in an upcoming blog in our series.

The ECB alone could play the ‘game changer’

A new study by the World Future Council shows, that a modest ECB Climate Bailout programme of 150 billion € per year could reduce global CO2 emissions by a whopping third by 2030! The programme would not even have to create new money, but only to reinvest the proceeds from expiring bonds of former quantitative easing programmes. Should other central banks participate in a Climate Bailout, a reduction of CO2 emissions to net zero globally by 2040 would even be possible.

150 billion € to cope with the global climate crisis appears to be a bargain, compared to the 1,350 billion € that — reasonably and without relevant opposition — is now being used to overcome the corona crisis. We need to start thinking about how to practically finance a swift transition to 100% renewable energies. And central banks should not just stop making things worse, they should start playing a proactive role. Let’s treat the climate emergency as what it is, and let’s bail out the climate, too!

About the series:

The Fossil Endgame blog series is organized by the Leave it in the Ground Initiative (LINGO) in collaboration with the Rapid Transition Alliance (RTA) and supported by the Dutch Committee of the International Union for the Conservation of Nature (IUCN NL).

LINGO works on speeding up the energy transition to 100% renewables, both by supporting frontline struggles against fossil fuel projects and by pushing forward game-changing approaches that can end fossils in years, not decades.

RTA provides evidence-based hope for a warming world. A rapid economic transition, including widespread behaviour change to sustainable lifestyles, is necessary to live within planetary ecological boundaries and to limit global warming to below 1.5 degrees. We gather, share and demonstrate evidence of what is already possible to remove excuses for inaction and show ways ahead.